Racism saves World Economy: Subprime Crisis Caused by Affirmative Housing Loans

Racism could have saved both the world economy from subprime meltdown, and saved Blacks from bankruptcy.

Anti-Racist affirmative housing rules forced banks to give mortgage loans to unqualified minorities. Blacks did not need to fulfill the same tried-and-proven loan prerequisites as whites.

Affirmative Housing Bankrupts Blacks, Banks, Nations.

Racism saves Blacks from mortgage default, bankruptcy and saves the world economy. Anti-Racism caused subprime crisis.

Anti-Racist affirmative housing rules forced banks to give mortgage loans to unqualified minorities [1,2, 3, 4, 5, 6]. US government forced banks to judge people by the color of their skin: Black and minority loan applicants did not need to fulfill the same tried-and-proven loan prerequisites as whites.

Subprime loans, in violation of scientifically derived sound banking practices, unsurprisingly caused foreclosure and grave financial losses for many upstanding Blacks. Affirmative action subprime loans were the root cause for bank distress and the world subprime crisis. {1, 2, 3]

See also Diversity destroys trust

Diversity is Strength!—and a Massive Housing Crisis

Uncovering the roots of the disastrous home mortgage bubble that popped last year will keep economic historians busy for decades. Yet, one factor has so far been largely overlooked: the bipartisan social engineering crusade to drive up the rate of homeownership by handing out more mortgages to minorities.

More than a negligible amount of the blame for the mortgage meltdown can be traced back to multiculturalism: government-mandated affirmative-action lending, demographic change, illegal immigration, and the mind-numbing effects of political correctness.

The chickens have finally come home to roost.

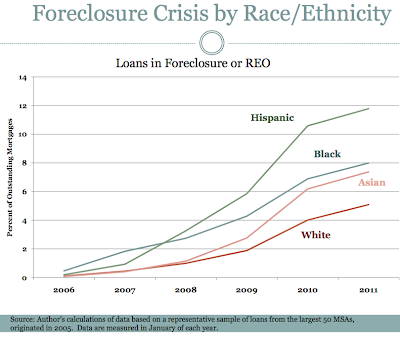

About half of all mortgages for blacks and Hispanics are subprime, versus roughly one-sixth for whites. Not surprisingly, the biggest home price collapses have occurred in heavily Hispanic cities such as Las Vegas, Miami, Phoenix, and Los Angeles.

The mortgage bubble was essentially a bet on the purportedly increased creditworthiness of the bottom half of the American population. After three decades of the home ownership rate stalling at around 64 percent, a series of federal initiatives to increase minority and low-income ownership helped push the rate up to just below 70 percent.

As this graph from a 2006 article by three economists with the Federal Reserve Bank of St. Louis shows, the great bubble of the last dozen or so years was driven by bets on marginal households well below the median.

Long before Bush came up with the phrase “ownership society,” Democrats had gleefully been using this justification to funnel vast sums of mortgage money to their base voters among minorities through the liberal-dominated quasi-state institutions Fannie Mae (once run by former Obama adviser Jim Johnson) and Freddie Mac and via leftwing NGOs such as ACORN (to which Obama had long and close ties). The government both devised de jure quotas and leaned on lenders with discrimination lawsuits to get them to impose their own de facto quotas.[read more]

End of summary

Supporting texts and links follow below

You can search on your own on PIGS: Politically Incorrect Google Search [?]

This is exactly how Democrats wrecked the economy with the subprime mortgage crisis. Then-Secretary of Housing and Urban Development, Andrew Cuomo, Sen. Chris Dodd and Rep. Barney Frank bragged about how they were helping minorities get mortgages by forcing banks to adopt ridiculously low lending standards. But once traditional measures of credit-worthiness were jettisoned, they were jettisoned for everyone. You will notice that the housing market crash was concentrated not in black neighborhoods, but in house-flipping hot spots. [Source: Ann Coulter]

Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them

Paperback – Bargain Price, November 23, 2010 by Peter Schweizer (Author)

Was the financial collapse caused by free-market capitalism and deregulation run amok, as liberals claim?

Not on your life, says Peter Schweizer. In Architects of Ruin, Schweizer describes how a coalition of left-wing activists, liberal politicians, and “do-good capitalists” on Wall Street leveraged government power to achieve their goal of broadening homeownership among minorities and the poor. The results were not only devastating to the economy, but hurt the very people they were supposedly trying to help.

Minority Lending AGAIN: Those Who Never Noticed the Past Are Condemned to Repeat It.

From the Associated Press:

Kept out: How banks block people of color from homeownershipby AARON GLANTZPHILADELPHIA (AP) — Fifty years after the federal Fair Housing Act banned racial discrimination in lending, African Americans and Latinos continue to be routinely denied conventional mortgage loans at rates far higher than their white counterparts.

By the way, if blacks and browns are People of Color, but whites and Asians are not, then what color are Asians?

Invisible color?

[Continue at Minority Lending AGAIN: Those Who Never Noticed the Past Are Condemned to Repeat It.]This modern-day redlining persisted in 61 metro areas even when controlling for applicants’ income, loan amount and neighborhood, according to millions of Home Mortgage Disclosure Act records analyzed by Reveal from The Center for Investigative Reporting.[…]

POST BY STEVE SAILER ON 03/07/2018

NYT: To Fight Racism, Let's Blow Up the Housing Market Again

The New York Times editorializes: The Race-Based Mortgage PenaltyBy THE EDITORIAL BOARD MARCH 7, 2018 As the Trump administration begins to gut federal enforcement of civil rights laws, minority communi...

Beyond that, the decision to withhold credit from minority neighborhoods has turned too many of them into hollowed-out areas with high poverty, failing schools, lower property values and a markedly worse quality of life.It’s a mystery wrapped inside a riddle inside an enigma.Not long ago, fair housing groups that uncovered particularly egregious lending discrimination by banks and mortgage companies could count on federal regulators to curb, at least, the worst forms of predation. …

Banks often claim that they deny mortgages in minority communities based on credit scores — but that claim is almost impossible to check, given that the credit scores are not publicly available.

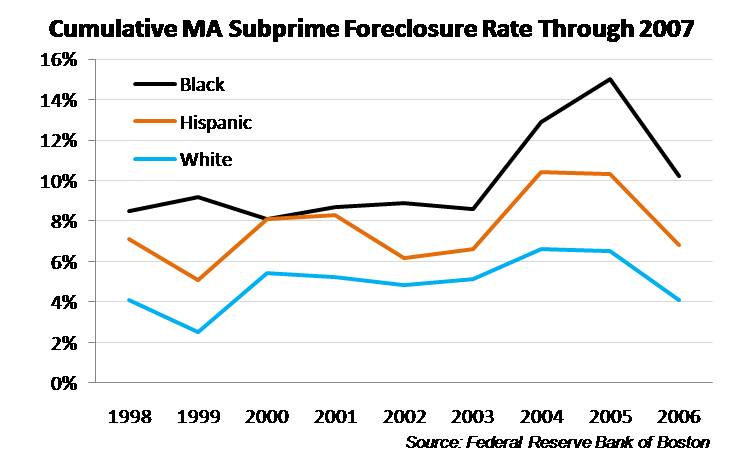

Here’s a graph created by Dr. Caroline Reid of the San Francisco Fed who almost nobody but my readers has ever seen. Default rates by ethnicity among the disastrous 2005 vintage of mortgages:

But who can remember the past when virtually nobody was ever told about the present?

iSteve Commenter Seth Largo adds:

The push to ensconce blacks and Hispanics in single family homes connects nicely with Steve’s running thesis regarding the mass luring of these demographic groups from the urban core to the suburbs and exurbs. If we can start handing out mortgages like candy again, we can get back to those golden days in 2005 when blacks and Hispanics were moving out to Adelanto and Ferguson instead of standing their ground in Boyle Heights.[Comment at Unz.com]

"Reverse Redlining"

Continue at "Reverse Redlining"The LA Times reports in "Civil Rights Complaint Targets Wall Street Rating Firms:"

In what is apparently the first legal action of its kind, an association of community-based organizations has filed a federal civil rights complaint against two of the three largest Wall Street rating firms, charging that their inflated ratings on subprime mortgage bonds disproportionately caused financial harm to African American and Latino home buyers across the country.

The complaint, filed by the National Community Reinvestment Coalition, alleges that Moody's Investors Service and Fitch Ratings enriched themselves by assigning high ratings to bonds backed by mortgages "that were designed to fail" because of "unfair payment terms and insufficient borrower income levels."

The firms "knew or should have known" that subprime loans disproportionately were marketed to minority consumers -- a process known as "reverse redlining" -- and that those borrowers would ultimately default and go into foreclosure at high rates, according to the coalition's complaint. ...

The filing cites multiple studies that found that African Americans and Latinos received a disproportionate share of subprime loans during the housing boom years. A Federal Reserve study in 2006 estimated that 45% of mortgages extended to Latinos and 55% of loans to African Americans were subprime -- a utilization rate "three to four times that of non-Hispanic whites."

Because the loans themselves often came with terms that increased borrowers' probability of default -- upfront teaser rates followed by unaffordable reset payment adjustments, no required documentation of applicants' incomes or assets, plus hefty prepayment penalties -- African Americans with subprime mortgages are projected to lose $71 billion to $92 billion through foreclosures, while Latinos are projected to lose $75 billion to $98 billion, according to one study cited in the complaint.

"Had subprime loans been distributed equitably," the complaint estimates, "losses for whites would be 44.5% higher and losses for people of color would be about 24% lower."Minorities got half of the subprime mortgage dollars (home purchase and refinance) in 2004-2007. My guess is that when somebody finally bothers to look, they will account for over half of the unexpected defaulted dollars.

PIGS Google Search

The Diversity Recession - Taki's Magazine

Sep 17, 2008 ... About half of all mortgages for blacks and Hispanics are subprime, versus ... The housing bubble, on the other hand, never made much sense. .... study and a new piece of legislation—ratcheted up mortgage affirmative action.

How the subprime crisis morphed into the Great Recession, Scott ...

... the recession, through affirmative policy steps beginning in 2007. ... E. Harding, After the housing industry slumped the Wicksellian equilibrium rate fell. .... of subprime loans sunk all home values, both prime and subprime.

Financial Affirmative Action | The American Spectator

Sep 29, 2008 ... Pointing to 2005 data that show subprime loans with high interest rates ... mortgage products, and investors kept inflating the housingbubble, ...

Affirmatively Furthering Fair Housing: Obama's Latest Disaster ...

Jul 20, 2015 ... It's difficult to say what's more striking about President Obama's Affirmatively Furthering Fair Housing (AFFH) regulation: its breathtaking ...

War on Suburbs: Obama, Julian Castro Rev Up Affirmative Action ...

Jul 29, 2015 ... Julian Castro, Secretary of Housing and Urban Development, wants more diversity in suburbs. And he'll use the federal government to get it.

The Case Of The “Disappeared” Subprime Minority Borrower ...

Sep 22, 2008 ... The financial debacle of a $1.4 trillion pool of subprime mortgages of which ... The US Fair Housing Act and the Equal Credit Opportunity Act prohibit ..... Noaffirmative redress action is available for short Ashkenazi Jews and ...

Unmasking the Real Culprits of the Housing Collapse | Frontpage Mag

Dec 20, 2011 ... ... a new bank shakedown at Justice for affirmative-action mortgages. ... His housing regulations actually created the subprime bubble and ...

Residents of Pr. George's Have Seen the Housing Crisis Erode ...

Jan 26, 2015 ... A Washington Post analysis of housing values in two suburban .... almost all Government workers who have rode the Affirmative Action gravy train to their .... It was the white homosexual left who forced subprime lending on the ...

Michelle Malkin | » The left-wing mortgage counseling racket

Apr 3, 2008 ... The White House has increased funding for housingcounseling by 150 percent ... were in operation when subprime borrowers got into the current mess. .... of poor people to accomplish energetic and affirmative advocacy.

Financial Affirmative Action Returns | The American Spectator

Jun 22, 2009 ... Financial Affirmative Action Returns ... helped to create the subprime mortgage bubble that violently burst and that continues to wreak havoc on ... Partnership Award from the Chicago office of Neighborhood Housing Services.

Racism is Love

Racism is Love